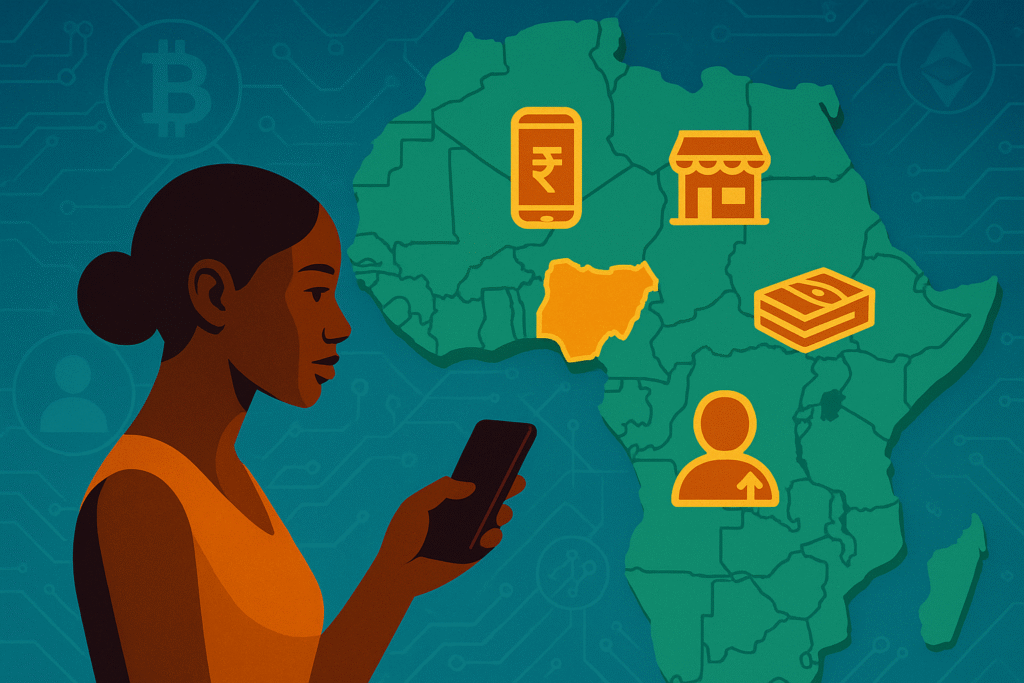

With just a phone, you can send, receive, save, borrow, or even invest — right from your pocket.

But here’s the big picture:

It’s not just a Nigerian story.

It’s an African revolution — and in 2025, it’s only getting bigger.

Let me break it down for you.

The Current State: Where Are We Now?

According to the latest GSMA report, Africa (especially Sub-Saharan Africa) now holds 1.1 billion mobile money accounts — over half of the world’s total 2 billion accounts.

Meaning?

Africa holds mobile money accounts.

- More than Europe.

- More than the US.

- More than Asia.

And in Nigeria alone, services like Paga, OPay, MTN MoMo, PalmPay have become part of daily life.

Or am I wrong?

If not, look at your smartphone — the one you’re using right now.

Aren’t you using it for:

-

Sending money to family

-

Paying NEPA bills or cable

-

Buying airtime and data

-

Running small businesses

-

Collecting payments as a POS agent

In short, things have become easier and easier thanks to something I call mobile money.

See, you need to be aware of the big picture of adoption rates and why we are winning.

But why are Africa and Nigeria leading the pack?

-

Banking gaps: Many rural or low-income Nigerians can’t access formal banks, but they have mobile phones.

-

Affordable services: Transfers as low as ₦50 or ₦100 make mobile money accessible to everyone.

-

Agent networks: Walk into almost any street, and you’ll see a POS or mobile money agent ready to serve you.

-

Digital hunger: Nigerians are quick to adopt tech that makes life easier — mobile money was no exception.

You see, this is not something I formulate because numbers prove it:

In 2023, mobile money contributed $190 billion to Sub-Saharan Africa’s GDP — up from $150 billion the year before.

That’s a massive contribution to Africa’s economy.

But here’s what you really need to know: what’s coming in 2025 and beyond?

Because this is where it gets truly exciting.

The trends shaping mobile money’s future in Africa include:

-

Expansion into new services — beyond transfers, we’ll see more microloans, insurance, savings, and even cross-border payments.

-

Partnerships with fintech startups — expect to see banks, telcos, and fintech companies join forces to roll out smarter, faster, and cheaper products.

-

Better regulations — as governments tighten oversight, expect stronger consumer protection and more formal integration into national financial systems.

-

AI and automation — faster identity verification, fraud detection, and customer service powered by artificial intelligence.

And for the average Nigerian, this means more opportunities to build, grow, and protect your money.

Meaning?

Opportunities for Nigerians (including You!)

So, what can YOU gain from these trends?

-

Small business owners can expand faster with mobile loans and easier payment collection.

-

Youth and students can tap into side hustles using mobile money platforms.

-

Rural families can connect to financial services without stepping into a bank.

-

Investors and entrepreneurs can explore fintech as a growing sector with massive potential.

In short:

Mobile money isn’t just changing how we pay — it’s changing how we live, work, and grow.

Conclusion

By 2025, mobile money will no longer be a “nice-to-have” in Africa — it will be the backbone of economic life.

And Nigeria, with its youthful, tech-savvy, ambitious population, is perfectly positioned to lead the charge.

So the next time you make that small ₦1,000 transfer on your app, remember:

You’re part of a continental movement shaping the future.